Present Value of a Single Sum

1. Definition and Formula

Present value is what an amount is worth prior to its receipt or payment.

The process of valuing a future amount at some prior date is referred to as “discounting,”

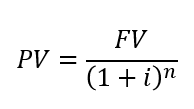

The present value (PV) of a single sum discounts a future lump sum amount by use of an interest rate factor as shown here:

where:

PV = present value

FV = future value

i = interest rate

n = number of compounding periods

Note the relationship among the variables:

- PV < FV; this is because money available in the future is not as valuable as money available earlier

- PV↓ as i↑: a higher interest rate means a greater proportion of the FV will consist of interest rather than principal.

- PV↓ as n↑: a longer time period (or greater compounding frequency) enables the PV to accumulate to a larger FV

2. Example

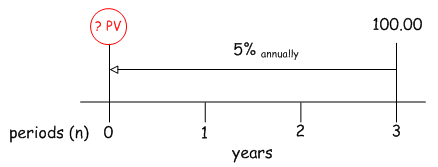

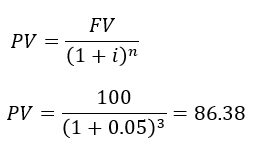

What is the current value (PV) of a CD that will pay $100 (FV) in 3 years (n) if the prevailing interest rate is 5% (i) compounded annually?

The problem statement provides values for three of the four variables in the equation: an investor will deposits $50 (PV) for three years (n) and this amount will compound annually at 8% to grow to a future amount (FV):

Thus, $86.38 invested today at 5% annual interest will grow to $100.00 in three years.

3. Concept

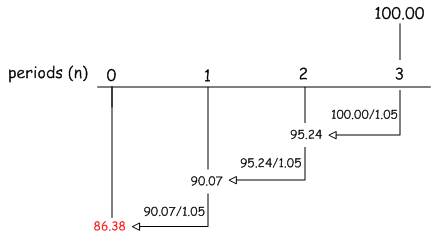

The mechanics of the discounting are illustrated here. Working backwards from $100 at 5% we see that this amount is worth only $95.24 if it were to be received in 1 year; $90.07 in 2 years; and $86,38 in 3 years.

In essence what “present value” means is that the receipt of $100 in three years’ time is worth the same as $86.38 today. The logic behind this assertion is that if we deposited $86.38 into an investment account paying 5% annually, it would grow to $100 in three years. In this case we should be indifferent as to our preference for receiving the money today or in three years because the two amounts can be considered financially equivalent.

Of course this is not entirely true. In reality there are a host of other factors to consider before we can declare “equivalence.” However, some of these factors (i.e., taxes, inflation, liquidity, credit risk, etc.) can be accounted for by choosing an appropriate interest (discount) rate.

While not precise, time value theory can still serve as a powerful tool for analyzing financial alternatives by providing a mechanism for placing cash flows at different time periods on a comparable basis.