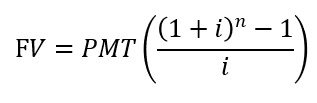

Future Value of an Annuity

1. Definition and Formula

The present value (PV) of a single sum tells us what a future amount is worth prior to its receipt or payment.

Typically we are looking for what an amount to be paid or received in the future is worth today.

The present value is calculated as:

where:

FV = future value

PMT = payment amount

i = interest rate

n = number of compounding periods

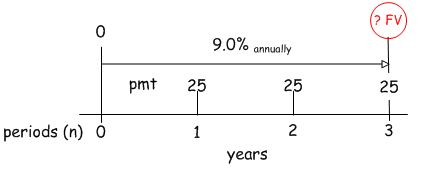

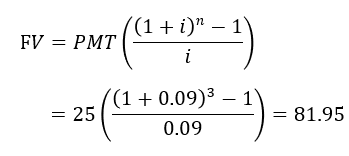

2. Example

What is the price you would pay today for a CD that will return $100 in 3 years if the prevailing rate of interest is 5% compounded annually? In other words, at 5%, what amount will grow to $100 in 3 years?

The problem statement provides values for three of the four variables in the equation: an investor will receive $100 (FV) in three years’ time (n) and this amount can be “discounted” back to today at 5% (i) in order to calculate the price of the CD (PV).

Thus, $86.38 invested today at 5% annual interest will grow to $100.00 in three years.

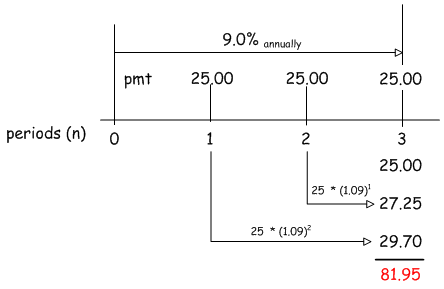

3. Concept

The mechanics of the discounting are illustrated here. Working backwards from $100 at 5% we see that this amount is worth only $95.24 if it were to be received in 1 year; $90.07 in 2 years; and $86,38 in 3 years.

In essence what “present value” means is that the receipt of $100 in three years’ time is worth the same as $86.38 today. The logic behind this assertion is that if we deposited $86.38 into an investment account paying 5% annually, it would grow to $100 in three years. In this case we should be indifferent as to our preference for receiving the money today or in three years because the two amounts can be considered financially equivalent.

Of course this is not entirely true. In reality there are a host of other factors to consider before we can declare “equivalence.” However, some of these factors (i.e., taxes, inflation, liquidity, credit risk, etc.) can be accounted for by choosing an appropriate interest (discount) rate.

While not precise, time value theory can still serve as a powerful tool for analyzing financial alternatives by providing a mechanism for placing cash flows at different time periods on a comparable basis.